Before moving to other topics in my future posts on tech & digital marketing, since I made the last two posts about Retail Media Networks –how important it is and will be & that it is a $100+ ecosystem already, I wanted to finalize the first series of posts on the ecosystem with an important topic: the retailer’s ad inventory.

To remind, we talked about three unique value propositions for RMNs: a) Onsite Ad Inventory b) Audiences c) Closed loop measurement (aka campaign performance). Among them, Ad Inventory has been a major driver of growth for top retailers globally, starting with Amazon as the first and prime example (pun intended).

Onsite Ad Inventory refers to all the in-store and digital placements (web/app) of the retailer that can be used for advertising.

In-store Onsite Ad Inventory

Historically, onsite placement was only in the retailers’ stores, where they were doing creative display campaigns with their brand partners. Example:

Coke Zero’s Inverted Pyramid in Manila

Nowadays, with more digitalization of stores, there are more screens for retailers to promote specific categories, items or brands. They are using either led screens like the ones below, or digital shelves, which is increasingly becoming popular. All of these digital screens are and will be ‘placements’ for retailers to sell advertising in their stores.

Degree deodorants promoting shoppers to exercise while waiting in the line1

While these screens and display placements in the stores, some of which can be found amusing or interesting by shoppers, are attractive monetization opportunities, they have two major problems:

- More aggressive (and less organic) than other advertising mediums which could end up being overwhelming for shoppers

- More expensive production with little to no flexibility for testing different creatives

Digital Onsite Ad Inventory

On the other hand, with the rise of e-commerce for all categories including grocery (partly because of COVID), top retailers continue to receive substantial amount of traffic to their websites and apps. These retailers now have the opportunity to introduce digital advertising placements in these real estates, and make it much easier for brands to promote their products to their retail partner’s customers, right when they are shopping on their site or app.

Amazon, being the biggest online retailer in the world, has the highest volume of traffic, thus has the highest digital onsite ad inventory among all retailers.

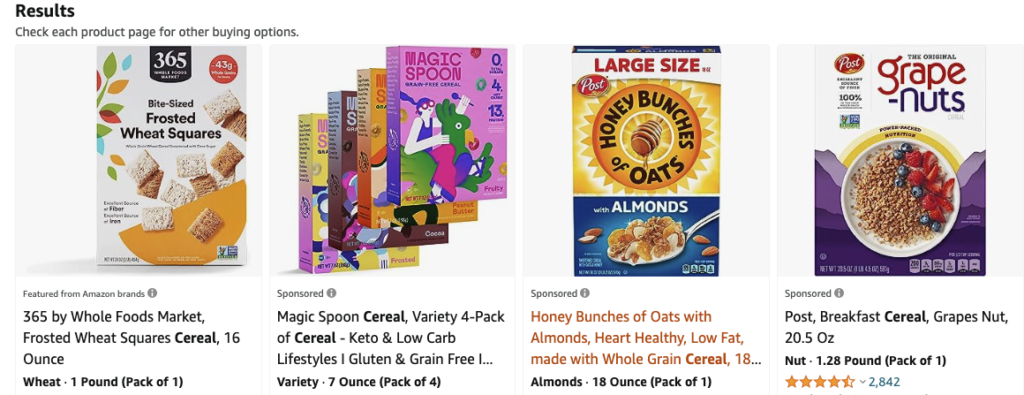

Just an example; when I search for ‘cereal’ on Amazon.com, the first line of products are all ‘sponsored’.

Amazon Ads

Same goes for other retail giants who have been seeing surge of visitors on their digital entities like Walmart, Tesco, Carrefour, or grocery delivery platforms such as Instacart. They are all utilizing their digital onsite ad inventory and monetizing it, for a good reason: brands love it! It makes a lot of sense for the brands to promote their products during the active shopping session of the shoppers, more importantly while the shoppers are searching for their category of products.

Digital onsite ad inventory has several advantages:

- Much cheaper to produce for the brands, compared to in-store activities

- No cost for the retailers (except the development of the infra, if they are not using any SSPs*)

- High value for brands, meaning higher CPMs for retailers, and higher revenue opportunity

- More flexibility on increasing the ad inventory, unlike store ad inventory (you can put only so many digital screens or display units in the stores)

However, there are a few caveats. First of all, not all retailers have enough visitors on their digital real estate to effectively monetize and generate meaningful revenue out of them. Even for the top retailers, the ad inventory consists of only the visitors who are actively in shopping mode, meanings they attract lower funnel shoppers, and have no access to mid and upper funnel. Secondly, the monetization of this inventory is no piece of cake. Apart from Amazon and Instacart (they cant be really categorized as ‘retailers’, they are digital natives by nature), Walmart is the only company among the traditional retailers who has cracked the code on this so far. They built self-serve advertising solution2 and have a large organization dedicated to selling, and supporting advertisers, which is why they generated $2.7bn advertising revenue in 20223. The rest of the ecosystem is still working on their self-serve advertising solutions or are actively utilizing SSPs such as Criteo or PromoteIQ.

*I will make a separate post about adtech companies and discuss SSPs there but brief context: SSP stands for Supply Side Platform, which help website owners / publishers (e.g retailers) monetize their ad inventory by providing ad formats, backend technology, and demand.

In the previous post, I referred to the profits margins of ‘onsite ad inventory’ from a Boston Consultancy Group analysis, showing that onsite ads has approx. 70-90% profit margins, showing how lucrative business opportunity it is for the retailers. However, it is limited. Why?

Here is why:

Retail Media Networks sit at the lowest point of the funnel where the intent is the highest, and the final purchase is made. Therefore, as a placement, they are incredibly valuable, yet limited. The lower we go in the funnel, the less people there are. This means, none of the retail media networks, including Amazon, can unlock the true potential of their media ambitions without the offsite channels.

Offsite Ad Inventory means the inventory that the retailer has to purchase from other publishers such as Google, Meta, Criteo, The Trade Desk etc.

These platforms give retailers access to the rest of the digital ecosystem by enabling them to run ads for their brand partners beyond lower funnel. This means, they can scale up through the funnel first with search engines, then with display networks or publishers. The good news is that retailers can usually continue targeting their customers (e.g Custom Audiences), and people who look like their customers (e.g Lookalike Audiences) for the brand partners in these offsite ad inventory placements. The bad news is though that it costs money for them to purchase inventory from these offsite placements (which is the CPM of the publisher itself), making the profitability of such placements lower for the retailers / RMNs. In the same BCG study, they refer to this figure around 20-40%, far lower than 70-90% of the onsite ad inventory. Still though, high profitability yet lower scale through onsite ad inventory combined with lower profitability (which is still on par or higher than their core business) but higher scale through offsite ad inventory will enable the retailers to truly unlock their potential with their media networks.

At Meta, that was partially my job. I led the efforts to build the initial solutions to enable retailers utilize Meta as an offsite ad inventory for their media networks. The solution that I made the business case and helped build is called Managed Partner Ads.

Managed Partner Ads has two versions: API and Lite. API is designed for the online marketplaces such as Shopee, Lazada, Aliexpress, Trendyol to offer Meta advertising to their sellers at scale. Managed Partner Ads Lite, on the other hand, is designed for the RMNs to help them easily create campaigns on Meta for their top brand partners and get reporting accordingly. Both advertising solutions have three unique capabilities compared to the other Meta advertising solutions:

a) Brand-level conversion optimization: optimizing the campaigns based on the purchases of the specific brand’s products (instead of all purchases on the retailer’s website/app)

b) Brand/Product-level reporting: ability to see conversion reporting per brand/SKU that can be reported back to the brand (not available in other solutions of Meta)

c) Centralized UI: ability to manage all brand partnerships through a centralized interface and monitor activity, and easily access campaigns which have issues.

When I quit Meta, Managed Partner Ads Lite was still in beta. Let’s see what my former colleagues will do with the solution in the future.

At the moment, retailers are still exploring the offsite ads placements while focusing primarily on their onsite ad placements, understandably. Sooner or later (possibly sooner), offsite ad inventory will become an incredibly important channel for the RMNs to scale their operations due to the sheer size of 1st party and broader audiences they can target for their brand partners with closed loop measurement they can offer.

References;

- Southeastern Grocers Enlists Grocery TV for In-Store Retail Media Expansion by Winsightgrocerybusiness

- Walmart Connect

- Walmart ad sales hit $2.7B as execs eye greater scale by MarketingDive