I mentioned Instacart for a few times in this blog, highlighting the superiority of their advertising solutions, as well as strong growth of their revenue1

I started using Instacart when pandemic hit San Francisco Bay Area. As a heavy user of Uber Eats for food delivery, Instacart became my go-to platform to get groceries delivered to me from several different retailer options in my area. I had tried other options in the past such as Amazon Fresh, GoPuff etc, but Instacart stood out with their technology and usability. It was an incredibly easy to find the stores, and products, manage the cart, select different delivery and payment options. Especially after the order is placed, I absolutely loved interacting with the Instacart shopper in the shop based on their real-time feedback on the particular product’s availability in the store, and asking for my inputs for changes or refunds.

All in all, it is an amazing service, led by Fidji Sumo, the CEO of Instacart, who is a former Meta executive. After Fidji’s appointment, I personally did not notice significant changes in the actual consumer experience, however there were increasingly more ads in the app over time. However, it was done so well, that the ads did not feel intrusive at all, and felt much more part of the organic experience. No surprise, because Fidji Sumo was part of the core team who built News Feed at Facebook, which has been primary revenue stream for Meta for a long time (nowadays, Stories and Reels are challenging News Feed for the time spent, of course).

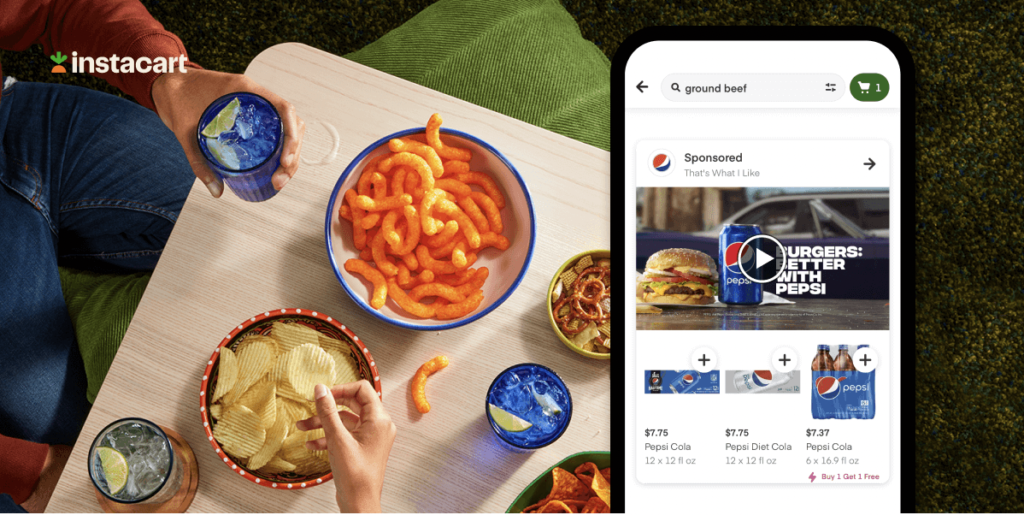

Thanks to this incredible success, Instacart Ads became one of the biggest players in the Retail Media Network ecosystem, after Amazon and Walmart. We have to acknowledge that Instacart is different than other ‘traditional’ RMNs, who are either directly storing products and selling from their warehouses (e.g Amazon Fresh), or are grocery stores with decades of experience (e.g Walmart). Instacart completes the transactions for the grocery purchases on its app, then sends their shoppers to the stores to complete the actual purchases of the products in the cart and delivery to the buyer’s home. In this process, they take on massive integrations with grocery retailers to list all their products and the latest availability/pricing information at store level. Thanks to these integrations and capturing the purchase signals on their platform (aka payments), they are able to offer advertising solutions to CPG brands with closed-loop measurement, as well as other unique capabilities. For example, different than other RMNs, Instacart can enable brands to advertise their products ‘across multiple retailers’. Say, you are Pepsi. Your product is sold across different retailers in a specific zip code to the shoppers. When you advertise on Instacart to these shoppers, you can simply place your ad on Instacart for whichever the retailer the shoppers prefer to use.

Instacart’s IPO Filing

On Friday, Instacart’s IPO filing became public here. The document includes a lot of details about the company, numbers, plans, risks etc to provide public sufficient information about their business, their vision and eventually get potential investors excited to buy their stock during the investor roadshow for the next few weeks and eventually when they are public (expected to be next month). As part of this document, I looked into specifically the sections related to Instacart Ads.

Size of the Instacart’s Ads Business

In 2022, Instacart generated $740m from advertising, which is 29% of their total revenue. This ratio was 31% in 2021, showing that their revenue growth from transactions was stronger than advertising. From 2021 to 2022, YoY Growth for advertising revenue is 29%. When we look at the first 6 months of this year (2023) vs last year (2022), the growth is 24%.

Important to note that we do not know is the gross or net profit margins for their transaction-based revenue vs advertising. I am assuming that each dollar brought in through transactions is more costly than advertising, making the advertising opportunity as or more attractive. This statements hints to my guess: “By growing advertising and other revenue and making fulfillment more efficient at scale, we have historically been able to increase gross profit consistently faster than GTV.”

The numbers show deceleration in YoY growth for their advertising solutions. This could mean that they are getting closer to the saturation of their advertising inventory (read more about onsite inventory here). I assume that they are working hard to add more locations within the US (and maybe beyond the US?) to increase the number of users, number of impressions, and as a result, number of onsite ad impressions and onsite ads inventory. However, they will also start adding offsite ads inventory to make their advertising solution more appealing to brands, and bring in more advertising dollars over time. Their ability to unlock more ads inventory, launch offsite advertising and growing the active advertisers will determine the success of their advertising business.

Instacart Ads

No surprise, they explicitly highlight the need for CPG brands to drive sales through diigtal channels with a full-funnel strategy in the filing.

As grocery moves online, CPG brands increasingly need to drive sales through digital channels. Brands have lacked access to a solution that runs a full-funnel marketing strategy purpose-built for online grocery. This is relevant for brands of all sizes, as even the most established brands must maintain mind share as consumers move online or risk being disrupted by emerging digital-first brands. Emerging brands face their own unique challenges in driving discovery through the traditional in-store model. Brands have historically lacked access to omni-channel insights to drive product development decisions, such as which items are selling and what consumers are searching for.

They mention that they provide this solution to more than 5500 brands, and they estimate that on average, their ads deliver more than 15% incremental sales lift. It’s not really a useful metric on its own, as we need to know the cost of those incremental sales to better understand the true performance/return of their solution. Also, it would be interesting to see which ad formats are delivering such high incremental sales, given their search ads or ad slots in the ‘buy again’ section of the app are most probably not driving very high incremental sales figures for top brands vs display ads.

They provide some details on different solutions they offer to the brands. Instacart Ads offers sponsored product, display ads, brand pages and coupons formats. All but brand pages are obvious choices for Instacart to offer as part of their ads solution. Brand pages, on the other hand, are specifically designed to allow brands to have dedicated pages for their products, where the consumers can then choose any retailer closeby to purchase them2. This is a very powerful way to attract brands, and make it much more convenient for them to advertise their products which are sold across different retailers.

They highlight their first party data (and resilience against the privacy policy changes), high ROI, self-serve ads management directly or through API, rich basket and customer insights as their value proposition for brands. They are using second price cost-per-click auction, a model that is used by Google, and Meta. They also mention ‘offsite ads’ capabilities as part of the future opportunities section.

Carrot Ads

Admittedly, I have not heard of this platform from Instacart until this filing. Interesting to see that Instacart’s Carrot Ads technology enables retailers to fill their onsite ads inventory with Instacart Ads through revenue sharing model. I have not heard any major retailer using their platform but lately, they announced that Sprouts Farmers Market, a relatively small but well-known grocery retail chain in Bay Area, started using Carrot Ads to kick off their retail media efforts3.

Risks

Overall, in the risks section of the document, they mention that advertising business is still in the early stages and is subject to different types of risks such as;

- Brands seem to work with Instacart on a campaign by campaign basis vs always-on. This puts extra pressure on Instacart Ads to always perform well for growth sustainability

- They need to continue bringing new brands into their platform and increase the investment of the existing brands to grow successfully.

- External risks like Apple and Google’s data policies, which could affect their ability to use the data for advertising purposes, or the macro-economic factors (e.g rising interest rates, increased inflaction, challenges in global distribution networks, war in Ukraine etc)

One risk I am seeing for specifically Instacart Ads, which was not mentioned explicitly in the document, is how retailers are perceiving its success. While some retailers might benefit from capabilities like Carrot Ads, others (especially large players) might see Instacart Ads as a risk or blocker against scaling their own RMN offering. Instacart is basically capturing the customer and purchase data that was supposed to be owned only by the retailer. I do not know whether Instacart shares purchase and customer data directly with retailers, I assume they do but probably to a certain extent. Still, retailers are probably not happy that a certain % of their ecommerce data is, at best, shared with Instacart who is already, and effectively monetizing it. This could create challenges in Instacart’s partnership agreements with these retailers in the future as these retailers have more aggressive growth expectations from their media networks.

Also, it is important to remember that for CPG brands, Instacart is still not a major player for their bottomline numbers. Per Insider Intelligence, Instacart’s market share among all other grocery delivery services is ~22%4. And considering that only 10-15% of all grocery sales is e-commerce, for a typical CPG brand, Instacart makes up no more than 2-3% of their bottomline5. This means that Instacart might not be seen as an indispensable marketing channel for brands, and could be subject to risks fo fluctuations compared to its RMN competitors.

Conclusion

I personally think Instacart still has major growth opportunities for their advertising business and provides an incredible playground for CPG brands to experiment performance marketing and capture uniquely valuable insights. What they achieved so far in such a short period of time is a proof that they are a successful technology company disrupting a traditional ecosystem with innovation.

Their growth trajectory for Instacart Ads will depend on their ability to

- find the best way to measure success (incrementality or ROI?) and optimize based on it

- increase onsite ads inventory

- expand their offering with offsite placements (e.g Google, Meta, Tiktok etc) and execute well

- ability to help retailers monetize their own ads inventory (compared to competitors like Criteo, Citrus Ads etc

And I think they will achieve all these, and start showing continuous growth in numbers. Let’s wait and see their earnings in the quarters to come.

References;

- Total Market Size for Retail Media Networks: >$100bn by mertcanli.com

- Inspiring Consumers with Instacart Ads’ New Brand Pages and Suite of Display Products by Instacart

- Sprouts Launches New Retail Media Network Powered by Instacart’s Carrot Ads Solution by PR Newswire

- Checking out Instacart in 5 charts by Insider Intelligence

- Online grocery sales will increase at 12% annual rate over 5 years, report says by Grocery Dive