Facebook Inc held its Initial Public Offering (IPO) on May 18, 2012. I was working at Facebook at the time, and it was an exciting day for all of us. Finally, after years of anticipation, the company was becoming public, and we would see how the rest of the world would value Facebook as a company.

The next 6 months was no fun. After Facebook stock was listed at the initial price of $38, as of July, the price hit lowest point, $17.55.

Chart generated by Google Bard

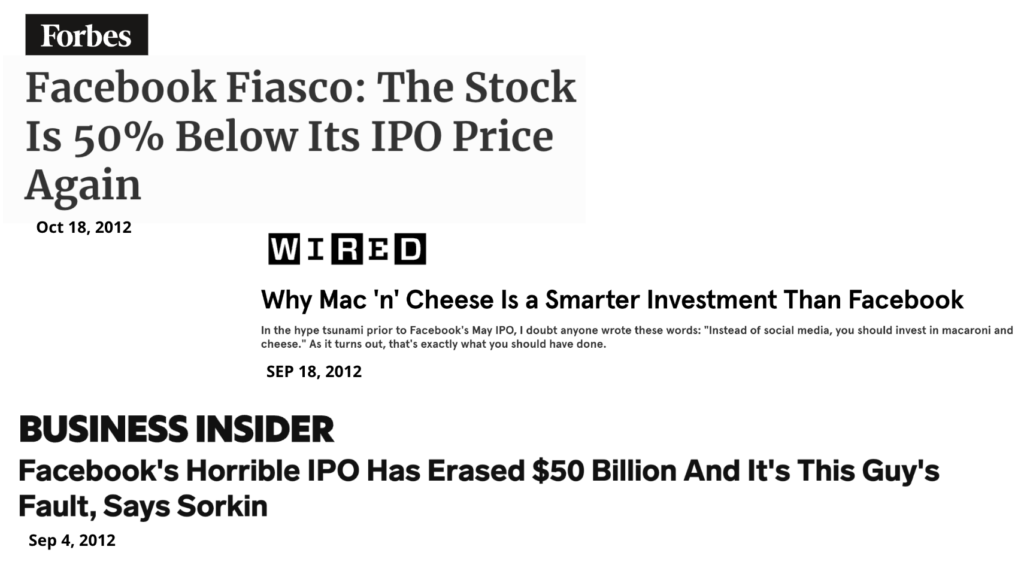

There were a lot of speculations around Facebook’s true value, and whether it is really the next big thing or will fade away soon. Both Zuckerberg and various executives of Facebook received a lot of criticism by media, more specifically by the early investors who had big hopes from the return they were expecting to have.

A few headlines from 2012 after poor Facebook stock performance

During these times, as a junior sales person of the company, I never felt extra pressure. Because the top executives knew what they had to do.

Lets dive into the theory of monetization, but we will come back to the Facebook story afterwards. Stay tuned!

How can publishers maximize revenue?

Meta is a publisher, which as ads inventory to sell to advertisers, same as Google, Yahoo (which was still a thing at the time), Twitter, and all other websites which were generating large volume of traffic, and ads inventory.

In order for publishers to maximize the revenue, they have to maximize either or both of the following parameters:

Total revenue = Total number of ads impressions x CPM (Cost per thousand impressions)

Supply

Total number of ads impressions is actually the ‘supply’ of the publishers. Publishers have different ways of creating ads impressions, for example:

- Search Engines: Google shows ads impressions in search results, meaning only when a person searches a keyword, there is opportunity for Google to show ads.

- News outlets: Wall Street Journal shows ads impressions for each page view, meaning only when a person loads a page to read an article, these publishers

- Social Media: Meta (Facebook and Instagram) shows ads impressions in their content feed (posts, stories or reels) between organic posts

In order for these publishers to increase the ads impressions, they need to increase the number of people searching for more keywords, reading more articles, or creating and consuming more social media content. Growth teams in these publishers are specifically trying to increase the number of people using their services as well as frequency or time spend of each person.

On the other hand, monetization teams are the ones who decide how many more ads they can show to users without disrupting the experience. If you think about Google, they started their journey in the early years by showing maybe 1-2 ads at the top of each results, and gradually increased the number (and layout) of the ads to increase their ads inventory. Similar trend happened in Instagram: There were an ad between 7-8 organic posts in the past, nowadays, on average, a user sees an ad between 3-4 organic post.

Important to note that increasing ads impression supply does not always increase the revenue. For the revenue to increase, there should be demand, which is covered below. You can have billions of ads impressions available for advertisers, but if they are not willing to spend on your platform, you will not make any money.

Example: Lately, there are reports1 that some major advertisers stopped advertising on X (formerly known as Twitter), due to brand safety issues. This means, X can have a lot of ads inventory but demand decrease means they will not be able to monetize those ads impressions as effectively.

Demand

Demand means a) whether there are companies out there who are willing to buy the ads impression (supply) and b) how much they are willing to pay for it.

All publishers with substantial users usually do not have problem with demand. There are a lot of small or large businesses who would like to promote their products or services on these publishers. However, what matters is how much they are willing to pay for each impression.

If the cost of running a full-page ad on New York Times would be $0.1, then NYT would not have any problem with demand. However, if it costs $50m to run a full-page ad on NYT, I do not think they would get a lot of calls from advertisers. So, this means the advertisers (aka market) determines the value of the ads impression, not the publisher.

How do advertisers decide on value?

Advertisers determine the value of impression, and they decide how much they are willing to pay for ads impressions (or clicks) on a publisher based on whether or not the ad is driving high Return on Ads Spend (ROAS). However, there are different definitions of ‘return‘ for different advertisers:

- Value of total sales

- Number of purchases

- Number of leads

- Number of subscribers

- % incremental sales

etc.

The other important factor in this evaluation is the measurement methodology. How does the advertiser measure the ROAS? Do they use ROAS metrics in Google Analytics? Do they use in-house measurement with more complex attribution models? Do they prefer lift studies to measure incrementality?

Check out this post about the impact of iOS14 changes on the ability of advertisers to measure the campaign performance for digital advertising.

As all of these are important factors for the advertiser to decide how much they are willing to pay for the ads impression, monetization teams in these publishers need to figure out ways to standardize these metrics, and try to maximize value for all advertisers who have different definitions of ‘return’. Thus, no surprise that they hire some of the brightest minds to figure it out.

In all these efforts, golden rule is to

Show the right ad to the right person at the right time

If monetization teams of these publishers are able to make sure that the most relevant ad is shown to each person at the right time, they can drive the maximum value for the advertiser and the user (so the user can see more interesting ads). The higher value advertiser sees, the higher amounts they are willing to pay for the ads of the publisher, the more money publisher can generate.

Summary

Supply and CPM increase multiply the revenue increase for the publishers. There are different tactics companies follow to increase them both but especially CPM changes are usually much less drastic due to the fact that the improvements on algorithms are incremental and show positive ROAS impact (if any) over time. While I am overly simplifying the model and dynamics in this post, it is important to note that this is a very complex topic. These supply and demand dynamics changes over time and vary per country, per advertiser group, per user group etc.

Back to Facebook story

After the collapse of Facebook stock in 2012, Facebook monetization team stayed calm, worked on powerful advertising and business solutions, and shipped them. What they were able to do exceptionally well was to be able to match the ads to the people at the global scale extremely effectively. How did they do that? They launched several advertising products to predict the intent of the user and increase the likelihood for them to engage with the ad. These products include but not limited to:

- Conversion optimization: Based on pixel/app event data from the advertisers, they were able to optimize which person should see an ad from the advertiser, that will maximize the chances for that person to buy the product or service. For example, Facebook would show Sephora ads to the people who are similar people who purchased lipstick on Sephora.

- Retargeting (e.g Website Custom Audiences, Dynamic Ads etc): Based on pixel/app event data from the advertisers, they were able to enable advertisers to target people who visited their website or app but did not complete purchase. For example, Sephora could target people who visited a specific lipstick brand, but did not purchase, to remind them if they were eager to come back and complete purchase.

- Remarketing (Custom Audiences2): Advertisers would share user identifiers with Facebook safely and privacy-friendly, to target their customers on Facebook and show them relevant ads.

All of these advertising solutions and more enabled Meta(Facebook) to increase the value of its ads inventory for advertisers, which increased the CPM prices gradually over the years.

Because of iOS14 changes, Meta is not able to able to optimize advertising based on the data from pixel/app events as effectively as before, but they invested heavily in machine learning and AI capabilities to sustain their ability to show the right ads to the right people, avoid the CPM prices falling down further. Despite their efforts, there are reports that show that Meta CPMs have dropped over the last few years.

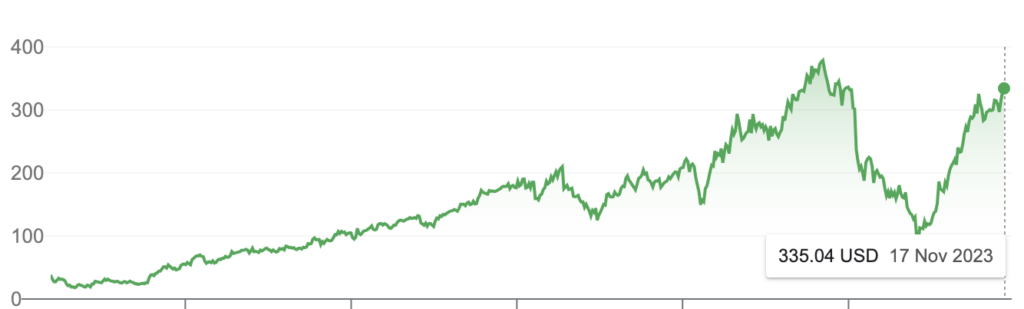

Still, Meta was able to recover from the early days of its IPO, and made a huge jump for the last 11 years since then.

Facebook/Meta Stock Value Change – Lifetime (Source: Google)

References:

- X ad boycott gathers pace amid antisemitism storm by BBC News

- About Custom Audiences by Meta Help Center