In my previous post, I provided a general overview on what retail media networks are and why I think they will be the future for retailers, and how they will be a powerhouse in digital marketing ecosystem for particularly brands in producer verticals such as CPG.

In this post, I will provide more quantitative aspect of how important Retail Media Networks are and will be in the near future.

Right off the bat, even though Amazon is a major player and has been around with their advertising offering for a while now, the RMN ecosystem is relatively new, thus the market sizing and projections are roughly high level. Also, top retailers are usually public companies who do not prefer to share their revenue figures from specifically advertising in detail, or for some of them, it is still insignificant. Still though, there are some reputable sources, who provided their projections on how big RMN ecosystem is now and will be in the future, which I want to discuss below.

One of the most recent articles is from Reuters referring to GroupM’s projections and says “Retail Media Network ads revenue will surpass TV by 2028”1. GroupM estimates that the total market size globally is $125bn in 2023, and will represent 15% of total ad revenue in 2028.

When we look at eMarketer’s latest projections2, they are predicting that the size of the market is $45bn in 2023 in the US, and is estimated to hit $106bn in 2027. If we use the regular “US is the 40% of the global ads market” formula, eMarketer is a little bit more conservative with their sizing than GroupM. Important to note that, while we dont know the exact formula of GroupM, eMarketer includes Amazon, eBay and Etsy into their calculation, flexing the definition of RMNs beyond traditional brick-and-mortar retailers.

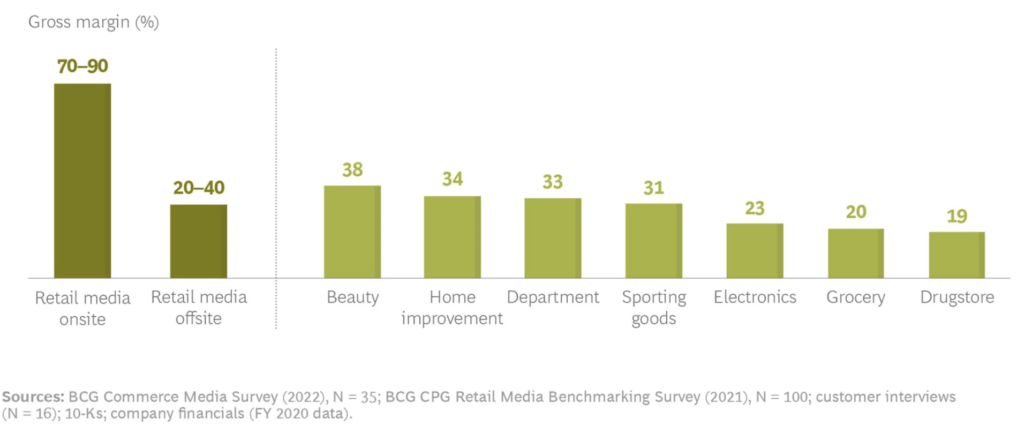

Boston Consulting Group shared a research as well on Retail Media Networks in March 2022, which projected the market size for the US to be $52bn in 2023, which is very similar to GroupM figures quoted in Reuters article. What is particularly interesting in this article is that BCG included specific projections for a category they call “commerce media” defined as the inclusion of “the expanded group of industries”. For commerce media, they only project it to be $10bn in 2026, which I think is vastly undervalued. The rest of the ecosystem, which includes some major online marketplaces in Asia and Latin America, as well as other categories like travel, real estate, entertainment, whom all have huge potential to become media networks themselves, should easily surpass the $10bn market size by 2026, in my opinion. Another interesting addition to BCG article is the gross profit margins for onsite and offsite media4, which are 70-90% and 20-40%, respectively.

While they compared these figures with gross margins of different category retailers in the graph above, and showing how attractive the gross margins of particularly onsite media is, I think the difference would be much more significant for the offsite media as well, if we would specifically look at the net profit margins, given advertising business has much less operational and other costs.

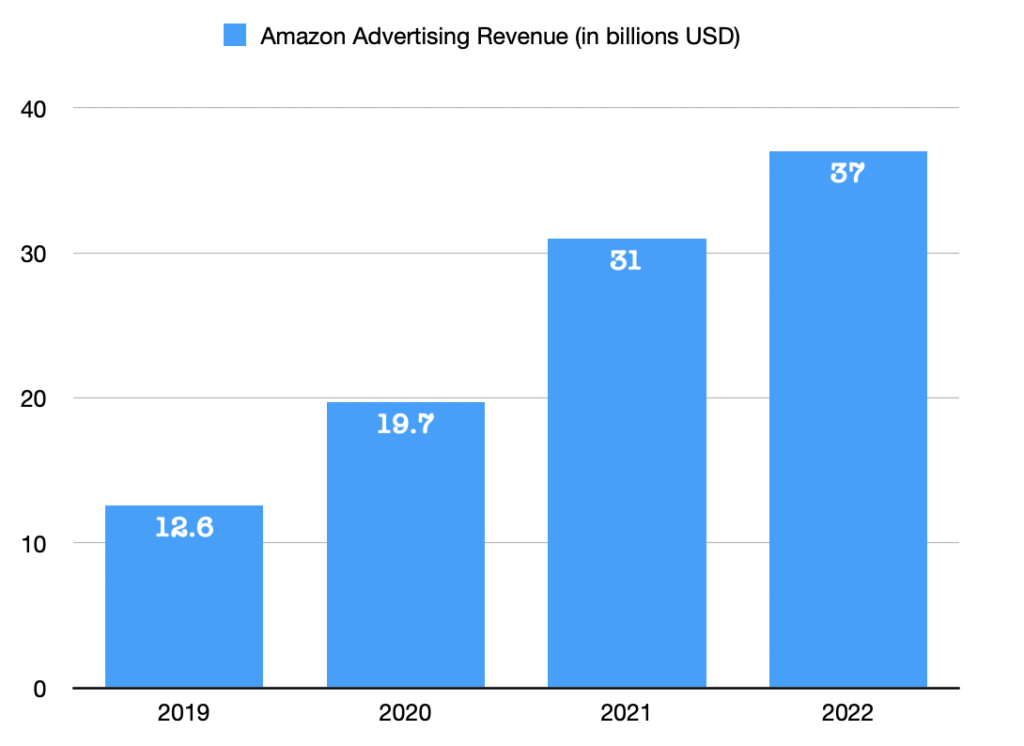

So, at this point, with all these data points from reputable industry leading companies, there should be no doubt in anybody’s mind that RMNs is a $100bn+ business globally already, and will continue to grow healthily over the next 5-10 years. Today’s projections include the biggest player of all, Amazon – running a $37bn advertising business, and it skews the data a bit. In the coming years, more retailers and online marketplaces will invest into this space more aggressively, and scale, and will break Amazon’s monopoly in RMN ecosystem.

Before ending the post, I want to share the latest ads revenue numbers of Amazon and Instacart.

Digging Deeper: Size of Amazon and Instacart’s advertising businesses

Amazon’s advertising business hit $37bn in 2022. In comparison, the tech giants, Google and Meta made $280bn, and $116bn last year. Of course, Amazon is far behind them, but it is also the third biggest advertising giant, and the only player who can truly threaten the duopoly, even though advertising is not their core business.

Even though their YoY growth rate slowed down last year (~19%), their growth is much higher than Google and Meta. Google grew only by 9% (important to note, still very strong considering their size), and Meta declined by 2% YoY.

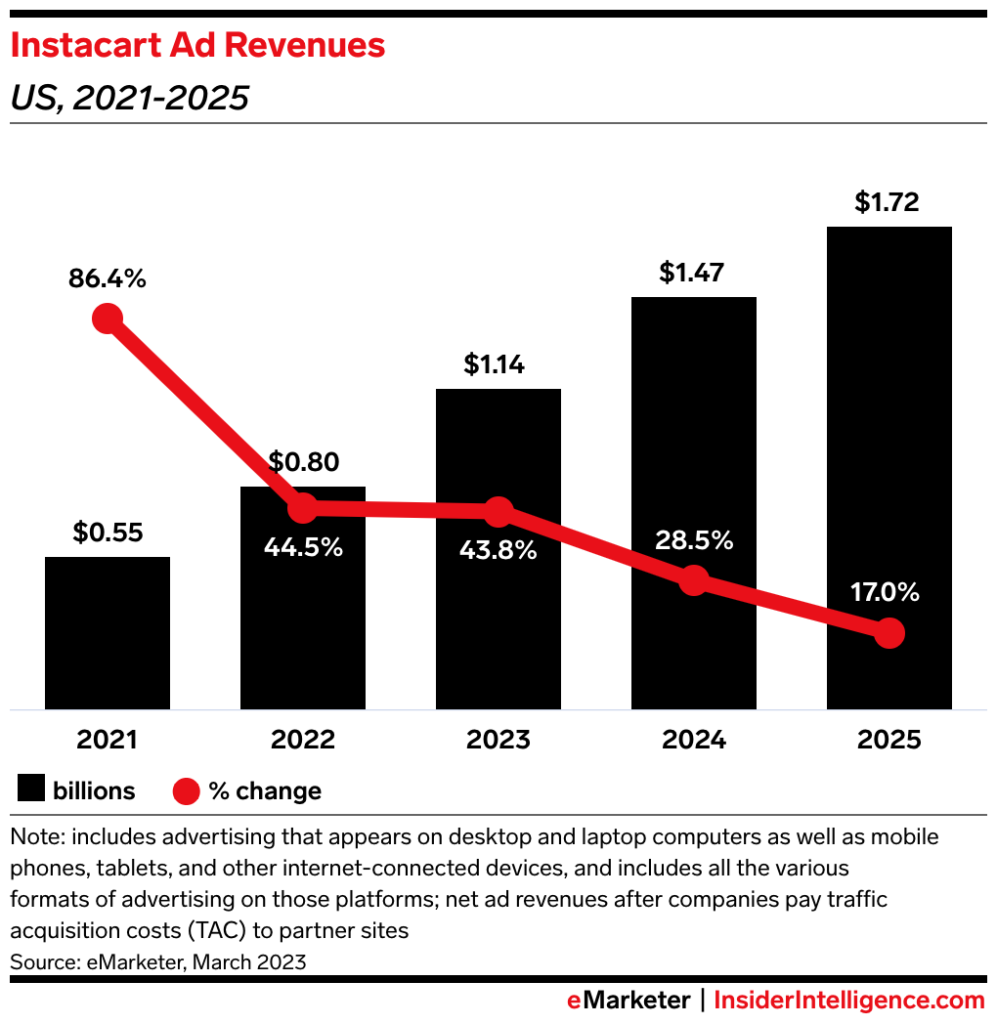

Instacart, a much newer player in retail ecosystem, is projected to hit over $1bn advertising revenue in 2023 with a staggering 44% YoY growth. I have to say, among all RMNs, I am most impressed with Instacart’s success due to their ability to embed the advertising so organically into the overall app experience (speaking from my personal usage of the service while I was living in San Francisco).

I intentionally chose these two examples to do a further quantitative deepdive in this particular post, as both of these players are digitally born, and native compared to the rest of Retail Media ecosystem, which consists of relatively traditional, large conglomerates, or small businesses. These two companies’ ability to move fast and create effective advertising solutions for their brand partners, and help consumers discover new brands and products easily on their platforms, should shed the light to the path of the traditional retailers, who hold so much more power (and data) in this particular ecosystem.

References;

- Retail media ad revenue forecast to surpass TV by 2028 by Reuters

- Retail media ad spend will more than double by 2027 by Insider Intelligence – eMarketer

- How Retail Media Is Reshaping Retail by Boston Consulting Group

- Onsite ads refer to the advertising placement on the retailer’s own real estate (e.g website, app, tvs in the store etc), Offsite ads refer to the advertising placement the retailer would purchase outside of their network (e.g Google, Meta, DSPs etc). I will make a post about this and discuss more in detail.