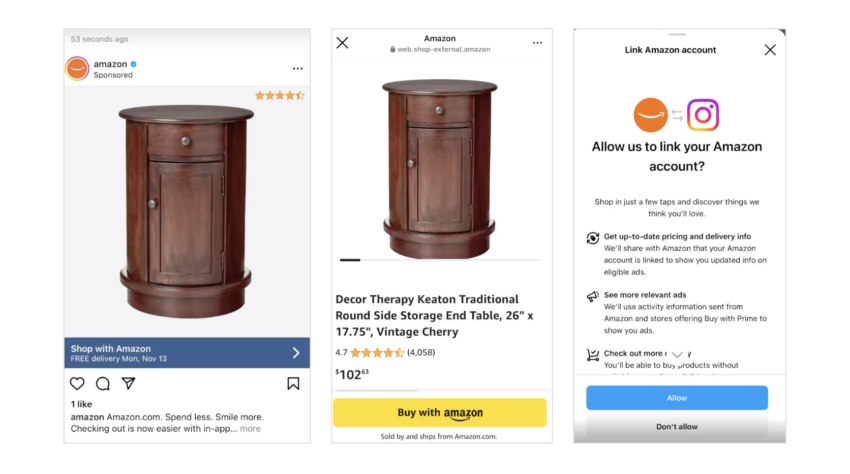

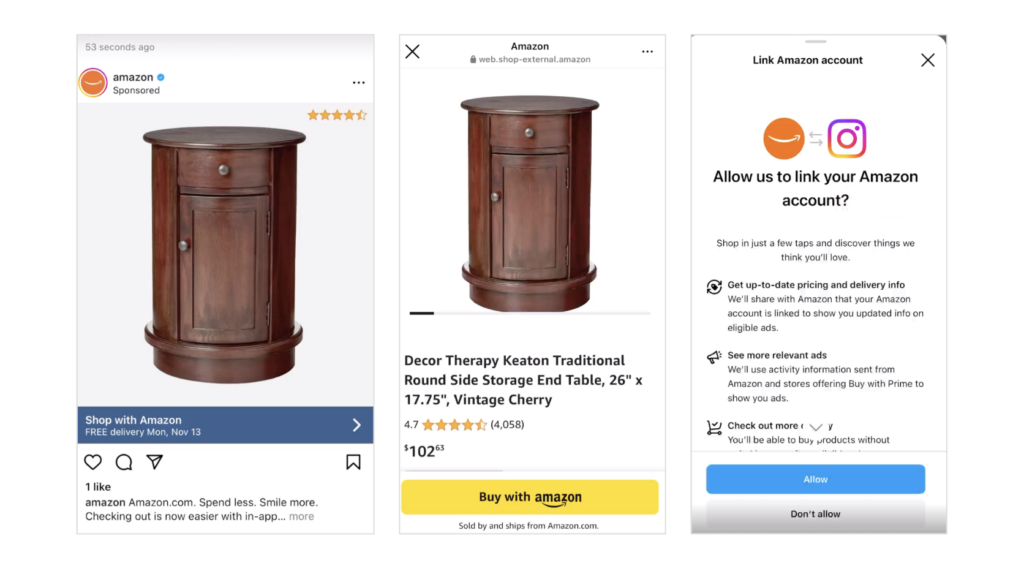

An important announcement was made last week about the partnership between Meta and Amazon related to Amazon’s advertising and commerce activity on Meta platform. This means after clicking an ad from Amazon on Facebook or Instagram, Meta users will be able to connect their Facebook or Instagram accounts to Amazon, and purchase products easily within these apps with their default payment and shipping address on Amazon.

Source: Maurice Rahmey’s post

Why is this an important announcement?

Meta and Amazon have been in different side of the digital ecosystem for a long time. Meta focused on bringing people together to enable deeper connections between them and share/consume content, whereas Amazon made it easy for people to buy products and deliver to their homes as fast as possible (thanks to Prime!).

However, both platforms started to overlap over the years as Meta made attempts to bring commerce into the social experience of their apps, and Amazon invested in services such as Prime Video, Twitch, IMDB to increase the upper funnel content consumption beyond their core e-commerce/marketplace identity. This meant, Meta wanted to enable product discovery on its apps, and Amazon wanted to expand their horizon with increased time spend on its platform and services.

The reality though was that these two companies’ attempts to build other services were never a direct competition. Yes, people could stream gaming on Facebook or purchase products in Marketplace, Groups etc, and yes, Amazon’s acquisition of Twitch was to gain share in social media within specifically gaming niche, but none of them were substantial investments to put them in direct competition unlike others (e.g Amazon vs Google in low funnel signals, Amazon vs Microsoft on cloud services, Amazon vs Netflix on video streaming etc).

Instead, these two companies have always had very close relationship from top to bottom to make sure they explore different opportunities where there is maximum benefit for both. This partnership could be the biggest one so far, providing direct end-to-end commerce experience for the users from advertising to the final purchase.

Reasons behind the partnership

When we look at the core businesses of Meta and Amazon, it actually makes a lot of sense for them to partner on enabling seamless commerce capabilities as part of advertising. Amazon needs attention of people before they already have intent to buy something. Meta needs to make it possible for people to easily purchase the products they discover through advertising.

Important to note that it looks like this partnerships is exclusively on advertising, which means users will be able to buy products easily on Amazon after they click an ad, instead of seeing organic content from Amazon through their Facebook page or Instagram account (or Shop – explained below).

While both companies complete each other in theory, agreement on a partnership like this is still very challenging. There are a lot of major aspects in such deal to be aligned: data sharing (per consent), integration, troubleshooting, customer support etc. The fact that they were able to finalize the deal and announce it shows the amount of hard work that went into it for several years. Props to teams of both companies!

Another reason why both companies probably were more interested and motivated in partnering than ever before was iOS14 changes. As explained in this post, Apple’s changes in iOS14 for applications to ask for explicit consent to track user behavior led to significant negative impact on campaign performance and tracking between publishers like Meta, and advertisers like Amazon. This deal will also means that through such seamless experience, Amazon will see higher conversion rates, and eventually better performance (ROAS) for their Meta ads.

Meta’s Commerce Efforts

One of the latest efforts for Meta to bring commerce into its platforms was Shops1. This concept became much more important because of COVID19 and lockdowns. Meta aimed to help especially small businesses to use its platform to reach their customers and sell their services/products easily on Facebook and Instagram while their businesses had to close due to lockdowns. There are two ways to create a shop for a business:

- Link to offsite: Businesses can list their products in their Facebook or Instagram page, people can browse through them or discover them in search pages but eventually, when the user wants to purchase, they have to visit the business’ website to complete to purchase

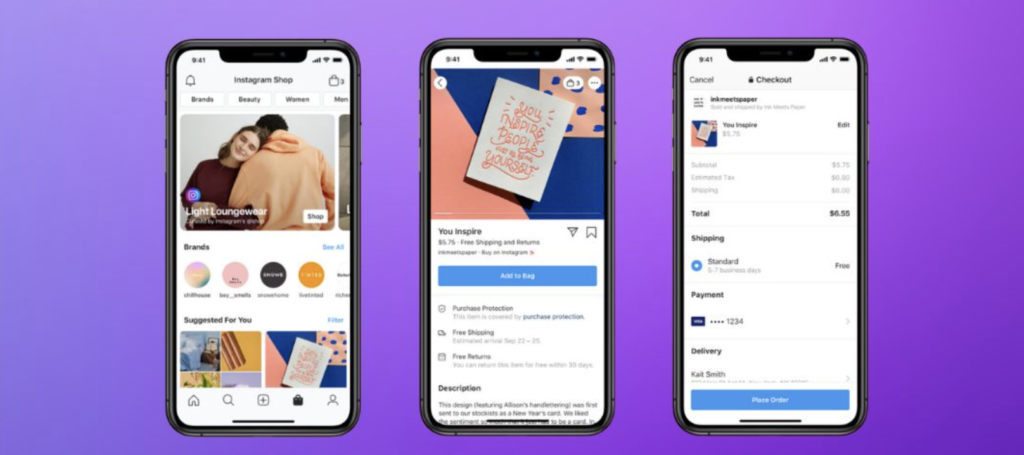

- Native checkout: Business can list their products but also enable purchase on Facebook or Instagram directly without the user having to leave the platforms. This is obviously more ideal experience for the users but the integration is harder. Thus, Meta partnered with Shopify and other commerce platforms to make it easier for small businesses.

The first option was announced to be deprecated in the US by April 20242, which means the only Shops with native checkout experience will be available moving forward in the US. In 21 other countries3, this option will still be available until further notice because Meta does not support native checkout outside of US yet. And in the rest of the world, they already stopped supporting Link to Offsite Shops.

Important: This partnership between Amazon and Meta is NOT ‘shops’ partnership. If Amazon would use Shops with native checkout, the experience would look like below. Instead, this partnership is related to Amazon Ads still directing users outside of Instagram and Meta, like any Meta ad would do but enables the direct purchase inside the ‘in-app browser’ without having to go to Amazon App to complete purchase.

Source: Godatafeed.com

Amazon’s Advertising Efforts: Are Amazon and Meta competitors?

Let’s not forget that Amazon is projected to generate $45bn revenue from advertising this year4, making them a solid 3rd biggest player after Google and Meta in the digital advertising ecosystem. Even though there is competition for ad dollars between Meta and Amazon, due to the nature of their core business, as mentioned above, and especially Amazon’s much more diverse revenue portfolio, there has always been and will always be opportunities for these two companies to support each other and grow together. Amazon does not aim to replace Meta as the new social media company, and Meta does not aim to replace Amazon as the biggest marketplace. Amazon needs Meta (to reach more people) as much as Meta needs Amazon (to have them as a strategically important advertiser).

However, I do not think such opportunity exists between Amazon and Google or Microsoft (or even Apple). Amazon is primarily a consumer product targeting people with intent to buy. This puts them against Google, more or less head to head. Core value of their advertising solutions are low funnel due to high intent, thus competing for basically the same advertising dollars. Also, Google being the distributor of the traffic for purchase intent, whereas Amazon wants to be the only destination for people with purchase intent creates another layer of complexity between these two companies.

Fun fact: Amazon intentionally only provides bare minimum information in their order confirmation email to avoid Google scrapping the information from the email and use it in their advertising optimization system. For example, Amazon does not provide what exact product is purchased and does not link the user to the product details page (instead the link takes the user to the view order page, which is membership-gated).

With Microsoft, I do not think Amazon has a lot of interest in deeper partnership. I am sure the two are in touch but the level of engagement is probably much more limited compared to Meta, given Microsoft’s primary business is operating system, office software and cloud (which is in direct competition with AWS). Probably Apple is a potentially good partner for Amazon but there are limitations there as well. Given Apple’s business is mostly consumer electronics and app ecosystem, the opportunities are more for Amazon to sell Apple products or grow the use of their apps (Amazon, Prime, Twitch etc) in Apple ecosystem.

Closing thoughts: This partnership between Meta and Amazon could be start of a major paradigm shift for particularly Meta, as this clearly shows that Meta is a channel for retailers to sell and grow their business, which will motivate other e-commerce marketplaces or retailers to have similar partnerships with Meta for better advertising performance.

References:

- Introducing Facebook Shops: Helping Small Businesses Sell Online by Meta Business Blog

- Changes to Shops – Meta Help Center

- 21 countries that will continue having access to ‘offsite shops’: Australia, Brazil, Canada, Denmark, France, Germany, India, Indonesia, Italy, Japan, Mexico, the Netherlands, Norway, South Korea, Spain, Sweden, Switzerland, Taiwan, Thailand, the UK and Ukraine.

- Ad duopoly looks over its shoulder as Amazon ad revenues jump 26% by eMarketer