Followers of this blog is well-aware that I am particularly passionate about Retail Media Networks, and there are many posts about this very topic here. However, in this post, I will put retailers aside and briefly discuss the media network opportunity for other industries.

Media Networks have been a hot topic for retailers specifically because of the customer and transaction data they have, which can be utilized effectively in media spend for their brand partners such as CPG or Consumer Electronics brands.

Similarly, in other industries, such partnership opportunities exist.

- In travel industry, online travel agencies (OTAs) own customer and transaction data for flight and hotel bookings.

- Entertainment platforms such as event or movie ticket websites, also have the same the same level of data, which would be incredibly valuable for event companies, artists to promote their events to new audiences or existing fans.

- Mobile operators have huge customer bases with key information about them on their packages, device usage etc which can also be utilized for more effective media spend for consumer electronics companies

Top companies in these industries have been looking into this opportunity, but most of them did not make a lot of progress (except maybe top travel sites), compared to retailers. The primary reason is that CPG and Consumer Electronics verticals are massive advertisers and they heavily depend on their retail partners (esp. CPG). Therefore, retailers were able to realize sooner than later that there is a huge opportunity for them to partner with these brands and help with their media spend. Even though not all retailers made enough progress so far, some of the top players globally are already leading the pack and showing direction to the rest of the industry.

One example per industry

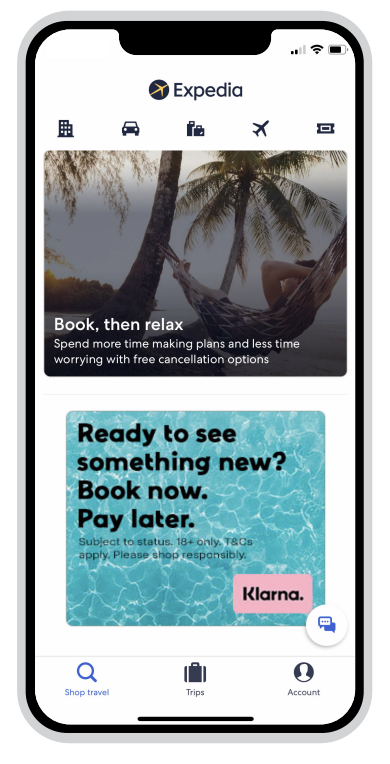

In travel, maybe we can use Expedia Group as an example, similar to Walmart. They already have a fairly advanced media network. From Sponsored listings, both for flights and hotels, to Native advertising, from planning tools to offsite advertising, they offer a wide range of services.

Their website does not have a lot of details beyond high level product descriptions, and they do not seem to have a self-serve platform for advertising. The website has a form, collecting demand which I assume eventually is directed to their sales team to contact prospective advertisers. It is also interesting to see that they have an example of a financial services brand, Klarna, in their display ads guide, meaning they are selling ads to ‘non-endemic’ brands too.

According to Statista1, Expedia Group generated a whopping $1.1bn in 2019, which made them the biggest media network after Amazon at the time (for comparision, Walmart generated only $500m that year). However, they were hit hard in 2019 due to Covid, and even though they were recovering gradually since then, they hit $777m revenue in 2022. If not Covid, we could see them grow as big as Walmart to $3bn+ levels as of now.

In entertainment, as the industry leader, Ticketmaster offers advertising solutions. Their website2 does not really provide a lot of information about their offering but their offering seems much less sophisticated than other industry leaders for sure. I also could not find any information about their advertising revenue, assuming it’s not meaningful in their bottomline.

In telecommunications, there is opportunity mobile operators to offer advertising services to consumer electronics companies, especially to the mobile phone manufacturers. AT&T, one of the biggest telecommunications company in the world, launched an advertising company, called Xandr in 20183 and started offering advertising solutions. However, they sold the company to Microsoft for an undisclosed amount last year, noting that “transaction does not include the advertising sales business supporting DirecTV.4 The statement means that they sold the technology (DSP & SSP) and the platform to Microsoft but the advertising inventory of AT&T remains with them, which makes sense. However, I could not find any public information about how they are selling their advertising inventory. I assume they directly engage with the advertisers and sell their inventory (and potentially other advertising solutions) through their sales team, given AT&T as a group owns WarnerMedia (the umbrella group for the likes of CNN, CBS, HBO etc).

Overall, among all these industries that I looked into, Travel has been the most advanced next to Retail in terms of media networks, with several top players offering relatively sophisticated solutions. While other industries also have similar opportunities, the total addressable market might not be as high as these two verticals to heavily invest in this area. Still, it is interesting to see how other industries also provide advertising services, small or big, to their brand partners, making ‘media network’ definition much broader than retailers.

References: