Social media companies have always shown interest in e-commerce capabilities on their platforms, but it is a tricky topic for them. Yes, they would like to introduce such capabilities to their users to increase commercial activity on their platforms and help sellers grow their businesses with them, but they also have the largest retailers and online marketplaces as their strategic advertisers, who could see these moves as a threat for their business. They need to strike a delicate balance to achieve their commercial ambitions while not pissing off their strategic advertisers.

Meta built a successful C2C marketplace, introduced shops on Facebook and Instagram, and enabled payment options on Whatsapp to make it easier for small businesses to complete transactions in Brazil, India and Singapore.

X (formerly known as Twitter) also launched their version of Shops last year, but has not yet introduced payments natively on the platform. They experimented “Buy Button” in 2014 which could be added to a tweet and gives the chance to people to buy products directly on Twitter, but was eventually shut down 3 years later1. Still, there are reports that they recently applied to get US state licenses, and actively looking into adding more commerce capabilities to diversify their monetization strategy.

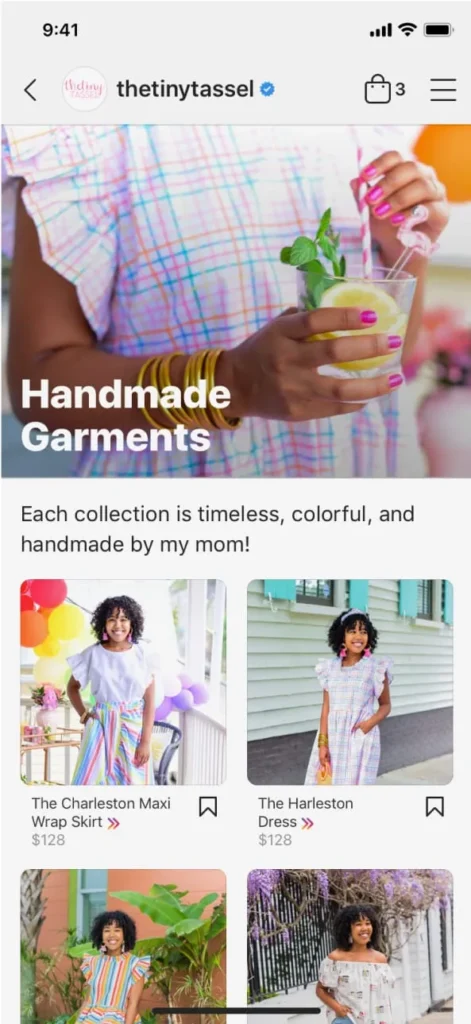

Tiktok is also no stranger to this space. They offer Tiktok Shops feature which enables sellers (such as businesses and creators) to list their products, be part of Shop feed/Live Shopping/Shoppable videos, utilize Shop Ads, get support for fulfillment and checkout services. They are the most advanced among its peers to offer wide range of commerce services. Tiktok Shops are available, as of now, in Malaysia, the Philippines, Singapore, Thailand, the United Kingdom, the United States, and Vietnam. However, it is not available in Indonesia, the second biggest country for Tiktok.

Countries with the largest TikTok audience as of October 2023. Source: Statista

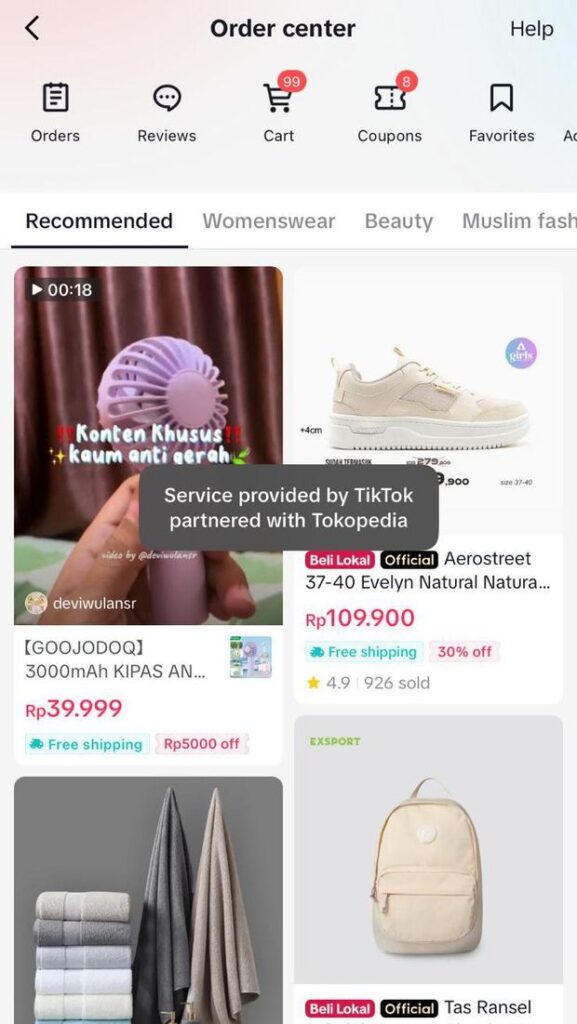

It’s not that they ignored Indonesia for some unknown reason. It is because they launched Tiktok Shops in Indonesia in 2021, which was wildly successful but got banned by Indonesian government last October, as part of a regulation which forbids social media applications to complete payments on their platforms.

“One of the things that is regulated is that the government only allows social media to be used to facilitate promotions, not for transactions,”2

As a result, Tiktok had to shut down their Shops feature, but did not give up on their e-commerce ambitions in the country. This week, Goto, owner of Tokopedia, the largest online marketplace in Indonesia, announced that they agreed on building a joint venture with Tiktok, in which Tiktok has 75% of the share3. This new joint venture will own Tokopedia and Tiktok Shops, giving a significant power to Tiktok to continue offering e-commerce capabilities to its users in Indonesia under the umbrella of Tokopedia.

How does Shops feature work in Social Media platforms?

Before we talk about the potential consequences of Tiktok’s investment in Tokopedia, let’s first understand better how Meta, Twitter, and Tiktok embedded commerce capabilities into their shops features. All shops are aimed to enable small businesses and creators to list all their products on their business pages in these platforms and help their audience discover and eventually buy them. However, beyond discovery, different shops enable different capabilities. There are primarily two types of shops:

Offsite shops

These shops showcase the products, product details, but eventually direct the users to the business’ own external website to learn more about the product, add to chat and complete purchase. This means, in these ‘offsite shops’, the transaction does not happen on the social media platform. Twitter only supports these type of shops. Meta did support it in the past, but as they announced in April4, they do not support ‘offsite’ checkout for new shops anymore, they will stop supporting the existing ‘offsite shops’ in the US as of April 2024. In 21 other markets, they will continue supporting existing ‘offsite shops’ until further notice. Tiktok on the other hand did support purchase on external website first but, as far as I could learn on the web, they stopped supporting this feature.

- Pros: Easy setup and high intent traffic from social media platforms for sellers, large volume of structured product listing for social media platform, easy discovery of products from businesses and creators for users

- Cons: Challenges of completing purchase offsite due to additional steps for users, lower conversion rates for organic and ads traffic for the sellers, no conversion signal for the social media platforms to optimize and measure for organic and ads activity

Onsite shops

These shops make it possible for the seller to sell their products right on the social media platform without having to leave it to complete the purchase. This means the social media platform offers either native fulfilling, shipping and payment options, or third party integrations to enable such capabilities. Therefore, offering such capabilities require deep technical integration with different platforms offering e-commerce infrastructure services. Twitter does not provide such capability, whereas Meta and Tiktok do. Meta supports ‘onsite shops with native checkout option only in the US. Tiktok, however, supports onsite shops in 7 countries as mentioned above.

- Pros: All benefits of offsite shops + Easier completion of purchase from discovery for users natively on the social media platform (leading to higher conversion rates for sellers, and high volume of signals for social media platforms to optimize advertising and organic activity effectively)

- Cons: Slow progress or risk of shutdown due to government regulations against competition and fraud, as well as deep technical integration needs and troubleshooting challenges

Now that we know what we are talking about, lets go back to Tiktok’s investment and what it means.

What does Tiktok’s investment in Tokopedia mean?

While it is clear that Tiktok is very ambitious make e-commerce experience for Tiktok users as native as possible to increase the volume of transactions going through their platform, it is not clear why they do that. There are a few benefits of this move for Tiktok.

- Monetization through commissions for each product purchased (Example: 1-2.5% in PH depending on the category5)

- Increased dependecy of the businesses and creators on Tiktok compared to other social media platforms and online marketplaces

- Improve performance and reporting of their advertising solutions by avoiding to rely on third party cookies, affected by Apple and Google’s privacy regulations6

The first two are more related to e-commerce efforts, and third one is related to advertising efforts of Tiktok. Now, among these benefits, it is not clear which one is the primary goal of their investment in Tiktok Shops or Tokopedia. For example, Tiktok charges much lower fees in PH compared to Shopee, one of the leading marketplaces in South East Asia, which charges on average 4% fees in the same market.

There could be two reasons for it:

a) Tiktok has lower commission to make it more attractive for new sellers to join their Shops platform but eventually wants to increase the fees and maximize monetization after they become market leader

A potential proof point for this is on Tiktok’s Help Center article7 saying that the lower fees are temporary: “No product listing fees. Get reduced commission from 5% to 1.8 % for the first 3 months.”

b) Tiktok will keep the commission lower in the long term to not only bring more sellers and keep them happy, but also make the prices more competitive on their platforms to increase volume of transactions, as well as conversion signal volume for their advertising solutions.

In short, [a] is to maximize the e-commerce monetization, [b] is to maximize the advertising monetization.

Even though we do not know exactly which of these areas they want to focus on to maximize revenue, there is a clear difference between [a] and [b] in terms of competition.

[a] means they are in direct competition with marketplaces and retailers, and will piss them off.

[b] means they see marketplaces and retailers as ‘partners’ and provide these companies a massive new sales channel, while keeping them as ‘happy’ advertisers.

This is exactly why Tiktok’s investment in Tokopedia shows much stronger signals for [a], than [b]. They are now in direct competition with other marketplaces such as Shopee and Lazada, in Indonesia, and other South East Asia countries. There is now much less motivation for these companies to see Tiktok as an advertising platform. Even though they do not have such investment in other countries they operate like the UK and US, this partnership is still giving a major red flag to online marketplaces and retailers.

How did Meta position their commerce investments?

When Meta launched their Marketplace on Facebook app, even though it started as and is still is a Consumer-to-Consumer marketplace, it led to a lot of anxienty among top marketplace globally, fearing that Meta would try to eat their lunch with this move. Over time, it became clear that it is not a major threat for these companies, due to the primary focus of C2C, and the concerns faded away for the most part. These marketplaces, such as Amazon, continues to work closely with Meta, even in an increasingly deeper partnerships8

However, Meta’s Shops launch created similar effect, and led to concerns on the same companies. It meant that Meta started to seriously invest in Business-to-Consumer commerce efforts, and would steal the sellers and brands of online marketplaces and retailers. They partnered very closely with Shopify and other commerce platforms, which enabled Meta to attract the huge seller base of Shopify to use Facebook and Instagram as a sales channel beyond their Shopify website.

Though, as opposed to Tiktok, Meta has always been neutral in their approach to the commerce efforts, and increasingly highlighted that their primary goal has always been to improve in advertising performance and measurement with increased ‘onsite conversion signal’. That’s why Meta’s Shop Ads became a central point for their commerce efforts, rather than purely focusing on driving organic transactions on their platforms. This helped soften the reaction of marketplaces and retailers, and kept them as strategic advertisers of Meta.

Closing thoughts

I find Tiktok’s move particularly risky, compared to Meta’s positioning of their commerce efforts. Companies, which feel the anxiety against Tiktok’s aggressive commerce ambitions, will feel more comfortable scaling their advertising investments and partnering with Meta. Tiktok, on the other hand, will be forced to choose a path: either become an e-commerce company, and competing against the likes of Amazon, Etsy, Shopee etc, or continue to be a social media company while ensuring that they are not in direct competition with these companies, and still get their advertising dollars. I think former is now much more likely than the latter, especially with this latest news.

References:

- Twitter’s ‘Buy’ button is officially dead by Vox

- Indonesia bans purchases on social media, in a blow to TikTok’s e-commerce ambitions by CNBC

- TikTok to invest $1.5B in GoTo’s Indonesia e-commerce business Tokopedia by Techcrunch

- Changes to Shops by Meta Business Help Center

- Marketplace Commission Fee by Tiktok Shop Academy

- Measurement of Digital Advertising: Before and After iOS14.5 by Mertcanli.com

- Seller Page by Tiktok Shop Academy

- Meta & Amazon’s Advertising & Commerce Partnership by Mertcanli.com